Home Buying Made Easy: Your Step-By-Step Guide

Home buying is a significant decision deeply influenced by personal requirements, emotional values, and financial constraints. The decision to buy a house requires thoughtful planning, local market insights, and a deep understanding of the home-buying process. While first home buying is a lifetime experience with unique pride and satisfaction of home ownership, it also comes with many challenges. If you are planning to buy your first home or invest in a return-promising property, this step-by-step guide may help you have a seamless experience throughout the process.

Assess Your Requirements: Assessing requirements for home buying is the initial step. Why do you need to buy a home? How big a home do you need? For how long are you going to use that home? What are the benefits of a first home for you? Is it better to buy a home than to live on rent?

Assess Your Available Finances: Budgeting is the most important step in the home-buying process. Before initiating the home buying process, conduct a thorough assessment of available finances to figure out how much money you can invest in home buying. Home buying involves many apparent and unapparent expenses; many of these you might not know. Here I list ten major expenses you should essentially consider paying during and just after buying your home, including-

Registration & stamp duty

Legal and documentation charges

Brokerage fees

Maintenance and society charges

Property insurance

Utilities and connection charges

Renovations and interior furnishing

Taxes and Surcharge

Loan processing fees

EMI

Choose the Location in Line with Your Investment Objective: Location is key to valuable real estate. Before finalising a locality for your home, consider the amenities you need. The purpose of home buying is a key selection parameter for choosing a locality. If you are buying a home as an investor, choose a locality that will stay in demand, increasing the resale value of your home. Here I list ten parameters to consider while choosing a location for home buying-

Proximity to work

Access to schools and educational institutions

Safety

Healthcare facilities

Amenities and services

Potential for future growth and development

Surrounding environment

Transportation and connectivity

Local community

Vibe of comfort

4. Research the Local Housing Market: Conducting thorough research to get insights into the local real estate market is a good idea; it helps you discuss with your real estate broker with better confidence. You should consider the real estate forecasts to make an informed decision. You can consult with prominent developers and real estate brokers before deciding on home buying. Here I list six parameters to consider while researching the local housing market-

Demographics

Historical data

Property value

Supply and demand

Current market trends

Opinion of communities

5. Check Your CIBIL Score for Home Loan Eligibility: Having good financial standing is the primary criterion to be eligible for a home loan. Your home loan eligibility mainly depends on your CIBIL score. This 3-digit score is a numeric summary (between 300 to 900) of your borrowing and repayment history. You can use free CIBIL score calculators. A credit score above 800 is considered good for an easy home loan; however, you can avail a home loan even if you have a lower credit score than this limit, because different financial institutions follow different criteria to decide the eligibility of a borrower.

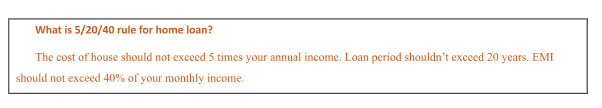

6. Plan to Manage EMIs and Down Payments: The Reserve Bank of India (RBI) mandates that lenders can provide loans only up to 80% of the property value. It means you need to pay 20% of the cost of the home as a down payment. A higher down payment can reduce your loan amount and improve your eligibility for the loan. The widely used 5/20/40 rule may help you.

7. Take Time to Find the Right Home: Having so many home availability options in the shortlisted locations, it can be a complex decision to choose the right one. It is a good idea to take your time to research the property type to ensure that it stays in line with your investment objectives. Here I list ten parameters to consider for finding an ideal home in the target locality-

Construction and architecture

Property’s age

Size of the house

Number of bedrooms

Suitability – present and future requirements

Possibilities for upgrade

Potential for passive rental income

Outdoor features

Energy efficiency

Maintenance requirements

8. Arranging the Required Home Loan: The Indian market offers a variety of loan options to suit different needs for home buyers. The standard Home Loan is the most popular loan type. Expanding the existing living space is a common need among homeowners. A home extension loan caters to this requirement by providing funds to extend the structure of an existing house. A home improvement loan can provide the necessary funds to cover the costs of repairs, remodelling, or upgrading existing properties. A Loan Against Property is a secured loan sanctioned, treating the existing property as collateral for funds. Here I list ten tips to help you choose the right lender for the required home loan-

Transparency

Quality of customer service

Loan eligibility

Digital advantages

Tenure flexibility

Interest rate

Hidden fees and charges, like the loan processing fee and the bounce charges

Repayment instalments

Tax benefits

Reputation and credibility

9. Essential Documents Required for Home Buying: When buying a home in India successfully, you need to assess different documents. Here, I list twelve must-check documents to assure the legal status of the investment you are going to buy -

1.Title deed

2.Sale deed

3.Building approval plan

4.Completion certificate

5.No objection certificates

6.Khata certificate

7.Encumbrance certificate

8.Occupancy certificate

9.Allotment letter

10.Possession letter

11. Statement from the bank if the loan is outstanding

12. Property tax receipts

10. Registration and Possession: Property transactions must be officially recorded for a number of reasons. The Supreme Court of India states that property ownership can only be transferred with the help of a registered sale deed, and mere possession or payment does not make one the owner legally. Property Stamp duty, levied by the state governments, varies widely depending on location, gender of buyer, Amenities, location, buyer’s age, purpose, age of property, etc.

11. Importance of Real Estate Broker: The Involvement of a real estate broker simplifies, streamlines, and expedites the home buying process from start to successful possession. When you involve a reputed real estate broker agency, it provides expertise, guidance, and support, helping you navigate the complex process, find suitable properties, explore loan options, negotiate offers, and manage paperwork, ultimately leading to a smoother and more successful purchase.

Wouldn’t you like to make your home buying a seamless experience? You can trust The Nestway Real Estate, one of the top real estate brokers in Jaipur, to buy a rightly priced first home or an investment property at prominent locations. To book your appointment with knowledgeable and experienced real estate professionals, call 8209377473 or email info@thenestway.in.